All Categories

Featured

[/image][=video]

[/video]

This can cause much less benefit for the policyholder compared to the financial gain for the insurance provider and the agent.: The illustrations and assumptions in advertising and marketing materials can be misleading, making the plan seem a lot more eye-catching than it could really be.: Understand that economic consultants (or Brokers) gain high payments on IULs, which can influence their referrals to offer you a plan that is not appropriate or in your benefit.

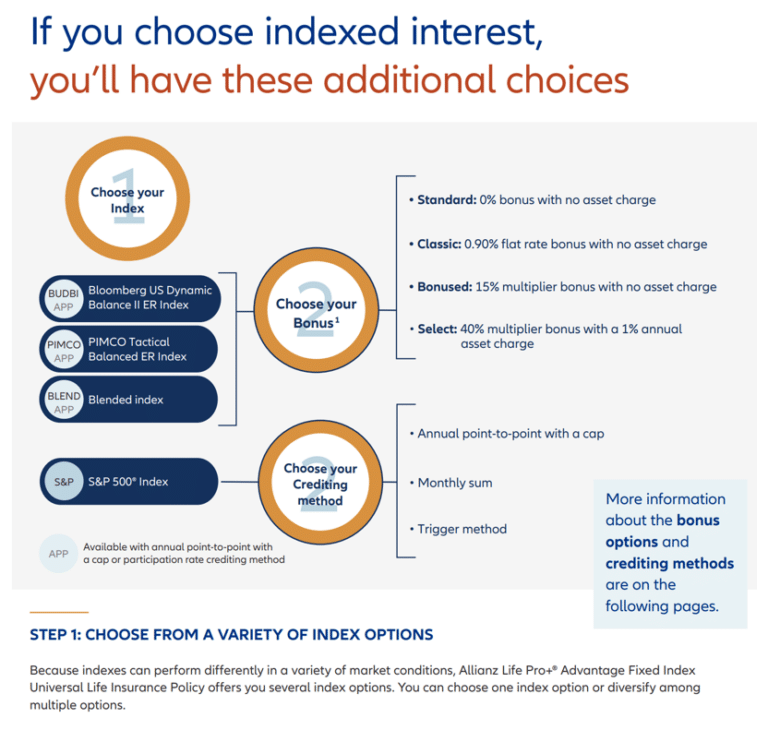

Many account options within IUL items guarantee one of these restricting aspects while allowing the various other to float. The most common account choice in IUL policies includes a floating annual interest cap in between 5% and 9% in existing market problems and a guaranteed 100% engagement rate. The passion gained equates to the index return if it is less than the cap yet is topped if the index return surpasses the cap price.

Other account alternatives might include a floating engagement rate, such as 50%, without cap, meaning the rate of interest attributed would certainly be half the return of the equity index. A spread account credit ratings interest over a drifting "spread rate." As an example, if the spread is 6%, the rate of interest attributed would be 15% if the index return is 21% yet 0% if the index return is 5%.

Rate of interest is normally credited on an "annual point-to-point" basis, indicating the gain in the index is calculated from the point the costs got in the account to precisely one year later. All caps and involvement rates are after that applied, and the resulting passion is attributed to the policy. These prices are changed each year and made use of as the basis for determining gains for the following year.

The insurance policy business acquires from a financial investment bank the right to "get the index" if it surpasses a specific degree, recognized as the "strike rate."The carrier might hedge its capped index obligation by purchasing a telephone call alternative at a 0% gain strike price and composing a call option at an 8% gain strike cost.

Tu Dortmund Iul

The budget plan that the insurance provider has to purchase choices depends on the return from its general account. If the provider has $1,000 internet costs after deductions and a 3% return from its general account, it would certainly assign $970.87 to its basic account to expand to $1,000 by year's end, making use of the remaining $29.13 to buy options.

This is a high return assumption, showing the undervaluation of alternatives in the market. Both largest elements influencing floating cap and engagement rates are the yields on the insurer's basic account and market volatility. Providers' basic accounts primarily include fixed-income assets such as bonds and mortgages. As returns on these assets have actually declined, service providers have actually had smaller allocate acquiring options, resulting in minimized cap and engagement prices.

Service providers usually show future efficiency based upon the historic efficiency of the index, applying existing, non-guaranteed cap and engagement rates as a proxy for future efficiency. However, this method might not be sensible, as historic estimates often mirror higher previous rates of interest and presume consistent caps and engagement prices in spite of diverse market conditions.

A much better method could be assigning to an uncapped involvement account or a spread account, which include acquiring fairly affordable options. These strategies, nevertheless, are less steady than capped accounts and might need frequent adjustments by the service provider to reflect market problems properly. The narrative that IULs are traditional products providing equity-like returns is no more sustainable.

With realistic assumptions of options returns and a reducing allocate acquiring choices, IULs may give partially greater returns than typical ULs but not equity index returns. Possible purchasers need to run images at 0.5% over the rate of interest attributed to conventional ULs to examine whether the policy is properly moneyed and efficient in providing guaranteed performance.

As a relied on partner, we work together with 63 top-rated insurer, ensuring you have access to a diverse variety of choices. Our services are completely totally free, and our expert consultants provide unbiased recommendations to assist you find the very best insurance coverage tailored to your demands and budget. Partnering with JRC Insurance Group indicates you receive personalized service, competitive prices, and satisfaction recognizing your financial future is in capable hands.

Allstate Futuregrowth Iul

We helped thousands of households with their life insurance coverage requires and we can help you as well. Professional examined by: Cliff is an accredited life insurance agent and one of the proprietors of JRC Insurance policy Group.

In his leisure he takes pleasure in hanging out with family, traveling, and the great outdoors.

Variable plans are financed by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Associate of National Life Insurance Company, One National Life Drive, Montpelier, Vermont 05604. Be sure to ask your economic advisor concerning the lasting treatment insurance coverage plan's attributes, advantages and premiums, and whether the insurance policy is proper for you based on your monetary scenario and goals. Special needs revenue insurance usually supplies monthly revenue benefits when you are unable to function due to a disabling injury or illness, as specified in the policy.

Cash value expands in an universal life policy via credited passion and reduced insurance policy prices. If the plan lapses, or is surrendered, any kind of outstanding exceptional car loans thought about in the policy may might subject to ordinary income revenueTax obligations A repaired indexed global life insurance (FIUL)plan is a life insurance product item provides supplies the opportunity, when adequately properlyMoneyed to participate get involved the growth development the market or an index without directly straight in the market.

Latest Posts

Indexed Universal Life With Living Benefits

Index Universal Life Insurance Wiki

Invest In Iul